The Best Guide To Pacific Prime

The Best Guide To Pacific Prime

Blog Article

The 10-Second Trick For Pacific Prime

Table of ContentsSome Ideas on Pacific Prime You Need To KnowSome Ideas on Pacific Prime You Need To KnowGetting My Pacific Prime To WorkPacific Prime - The FactsSome Known Questions About Pacific Prime.

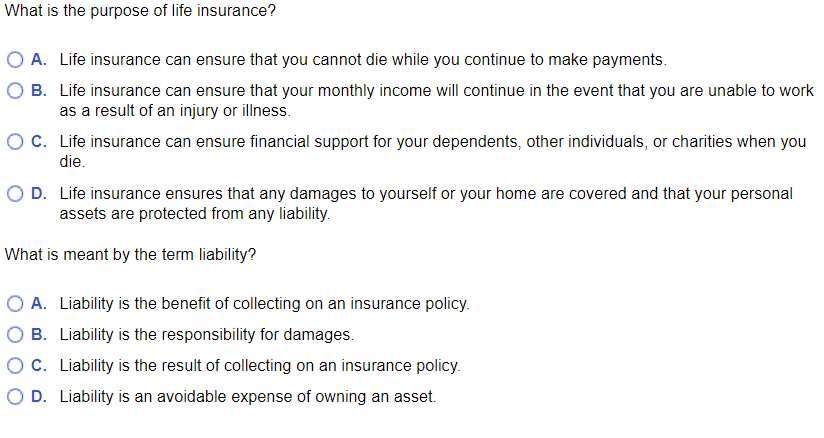

Insurance policy is an agreement, represented by a policy, in which an insurance holder gets economic defense or reimbursement versus losses from an insurer. The firm pools clients' threats to pay much more budget-friendly for the guaranteed. Most individuals have some insurance policy: for their cars and truck, their home, their healthcare, or their life.Insurance also assists cover costs connected with obligation (legal obligation) for damage or injury triggered to a third celebration. Insurance coverage is an agreement (plan) in which an insurance firm indemnifies another against losses from details contingencies or perils.

Investopedia/ Daniel Fishel Many insurance coverage policy types are available, and virtually any kind of individual or organization can locate an insurance policy firm ready to guarantee themfor a rate. The majority of people in the United States have at least one of these types of insurance, and car insurance coverage is called for by state law.

The Buzz on Pacific Prime

Discovering the price that is right for you needs some legwork. The policy restriction is the optimum amount an insurance firm will certainly pay for a protected loss under a plan. Maximums may be established per period (e.g., yearly or policy term), per loss or injury, or over the life of the policy, likewise called the life time maximum.

There are several various kinds of insurance policy. Wellness insurance assists covers routine and emergency medical treatment expenses, usually with the choice to add vision and dental services individually.

Many preventive solutions might be covered for complimentary before these are met. Wellness insurance coverage may be purchased from an insurer, an insurance representative, the government Wellness Insurance coverage Market, supplied by an employer, or government Medicare and Medicaid protection. The federal government no much longer requires Americans to have wellness insurance coverage, however in some states, such as The golden state, you may pay a tax obligation charge if you don't have insurance policy.

Our Pacific Prime Ideas

As opposed to paying out of pocket for automobile crashes and damages, individuals pay annual premiums to an automobile insurance provider. The company then pays all or most of the protected expenses related to a car crash or various other automobile damages. If you have actually a leased car or borrowed cash to buy an automobile, your lending institution or leasing car dealership will likely need you to lug vehicle insurance.

A life insurance policy warranties that the insurance provider pays an amount you could look here of cash to your recipients (such as a partner or youngsters) if you pass away. There are 2 primary types of life insurance coverage.

Long-term life insurance policy covers your entire life as long as you continue paying the costs. Traveling insurance policy covers the costs and losses connected with traveling, including journey terminations or delays, coverage for emergency situation healthcare, injuries and emptyings, harmed baggage, rental automobiles, and rental homes. Also some of the ideal travel insurance coverage companies do not cover terminations or delays as a result of weather, terrorism, or a pandemic. Insurance policy is a means to handle your financial threats. When you buy insurance policy, you buy security versus unforeseen monetary losses. The insurer pays you or a person you select if something negative takes place. If you have no insurance policy and a mishap happens, you might be accountable for all related expenses.

Some Known Details About Pacific Prime

Although there are several insurance policy kinds, some of the most typical are life, health and wellness, house owners, and car. The right kind of insurance policy for you will rely on your goals and economic scenario.

Have you ever before had a minute while looking at your insurance coverage plan or purchasing for insurance policy when you've believed, "What is insurance coverage? Insurance policy can be a mysterious and puzzling point. How does insurance work?

Nobody desires something bad to occur to them. Experiencing a loss without insurance policy can put you in a difficult monetary situation. Insurance coverage is a crucial monetary device. It can help you live life with fewer fears knowing you'll get financial aid after a disaster or mishap, aiding you recoup quicker.

The smart Trick of Pacific Prime That Nobody is Talking About

And in some instances, like automobile insurance policy and workers' payment, you might be called for by law to have insurance coverage in order to safeguard others - international travel insurance. Find out about ourInsurance options Insurance coverage is essentially a gigantic nest egg shared by lots of people (called policyholders) and handled by an insurance coverage service provider. The insurance coverage company makes use of cash accumulated (called premium) from its policyholders and various other investments to pay for its operations and to fulfill its pledge to insurance holders when they sue

Report this page